US seeks to reassure markets on debt after s&p warning

from dow jones

from dow jones:

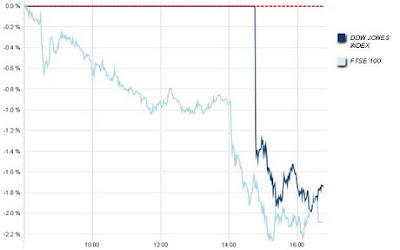

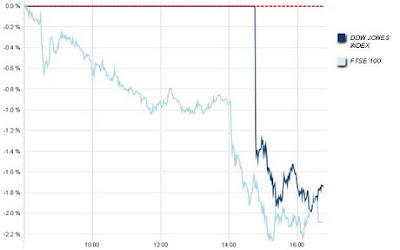

The Obama administration on Monday sought to reassure U.S. Treasurys investors, saying Standard & Poor's threat to downgrade America's top-notch debt rating underestimates the country's ability to face fiscal challenges.

S&P affirmed the U.S. federal government's "AAA" rating but, for the first time, changed its long-term outlook to negative from stable, signaling there's at least a 33% chance that it will downgrade the country's debt rating within two years.

The outlook revision comes as the White House and Congress are mired in a debate about how to contain the country's rapidly rising public debt. The International Monetary Fund last week pointed the finger at the world's largest economy, warning that a delay in slashing the budget deficit might cause the bond market to lose faith in the U.S.'s ability to do so, with ripple effects across the U.S. and global economy.

"We believe there is a material risk that U.S. policymakers might not reach an agreement on how to address medium- and long-term budgetary challenges by 2013," S&P said. Because of the U.S. budget process, this would mean agreeing on a broad deficit-cutting plan before the 2012 presidential elections, which many analysts view as a challenge.

S&P noted the gap between Republicans and Democrats about how to cut the deficit "remains wide." Even if an agreement is made, "there is a reasonable chance that it would still take a number of years before the government reaches a fiscal position that stabilizes its debt burden," S&P said.

related econocrash updates:

workforce in US drops to 27yr low;

as big US corporations moving jobs out of US*

for richest 400, income quadruples while tax rate plunges*

morgan stanley fails $3.3b debt payment, hands central tokyo office to blackstone*

even ben stein is warning an economic collapse is coming*

$50 silver - the price point of liberty*

video: crash jpmorgan buy silver

from washington's blog

from washington's blog:

Leading economists and financial experts say that our economy cannot recover until the too big to fails are broken up. See this and this. The giant banks have been sucking money out of the real economy and making us all poorer. But the government is refusing to even rein in the mega-banks, let alone break them up. One of the too big to fails - JP Morgan - manipulates the silver market. See this, this, this, this and this.

According to the National Inflation Association, JP Morgan is “short 30,000 silver contracts representing 150 million ounces of silver. This is one of the largest concentrated short positions in the history of all commodities, representing 31% of all open COMEX silver contracts.” This could leave JP Morgan exposed if people go out and buy physical silver in large numbers.

Mike Krieger and Max Keiser have an idea for attacking the weak underbelly of the seemingly invincible too big to fail banks and market manipulators ... all at the same time. Specifically, they say that if everyone buys just 1 ounce of silver, it will force JP Morgan - a giant manipulator of the silver market - to cover its short positions, and drive it out of business.

econocrash updates:

euro under siege after portugal hits panic button*

could erupting financial crisis lead to the end of the euro & the breakup of the european union?*

wall street quietly seeks to undo new financial rules*

'these numbers will increase': US sets 50 bank probes*

government employees owe billions in delinquent taxes*

more americans quitting jobs than being laid off*

penny-pinching consumers cutting cable, cell service*

wal-mart's secret study: inflation already here*

wash post runs '5 myths about federal reserve' written by rothschild economist*

video: 'quantitative easing' &

the money scam explained*

from dow jones: The Obama administration on Monday sought to reassure U.S. Treasurys investors, saying Standard & Poor's threat to downgrade America's top-notch debt rating underestimates the country's ability to face fiscal challenges.

from dow jones: The Obama administration on Monday sought to reassure U.S. Treasurys investors, saying Standard & Poor's threat to downgrade America's top-notch debt rating underestimates the country's ability to face fiscal challenges.